INFORMATION FOR INVESTORS

SHARE CAPITAL

Type, category and form of shares | Ordinary registered uncertificated shares |

|---|---|

State registration number of shares issue | 1-05-08443-H |

Par value of one share | RUB 1 |

Total number of outstanding shares | 2,276,401,458 shares |

Share capital | RUB 2,276,401,458 |

Trading code / ISIN | MOEX / RU000A0JR4A1 |

Number of shares purchased by the company | 0 shares |

In 2021, Moscow Exchange’s share capital remained unchanged. As of 31 December 2021, it amounted to RUB 2,276,401,458 and the number of outstanding ordinary shares stood at 2,276,401,458. Pursuant to the Exchange’s Charter, each share grants the right to one vote at the General Meeting of Shareholders.

The shares are traded on Moscow Exchange’s own trading platform (ticker: MOEX) and are included in the first-level quotation list. The shares are also a constituent of the Russian market benchmark indices, the MOEX Russia Index and the RTS Index, which are comprised of up to 50 stocks issued by Russia’s largest traded companies. They are also in the sectoral index for Finance and the equity sub-index of the Pension Savings Assets Index. As of 14 February 2022, Moscow Exchange shares were included in four thematic sustainability indices: MOEX-RSPP Responsibility & Transparency Index, MOEX-RSPP Sustainability Vector Index, MSCI Europe and Middle East ESG Leaders Index and FTSE4Good Emerging Index.

The Exchange’s shares are included in a number of global indices, such as those calculated by MSCI, MV Index Solutions, S&P, FTSE, STOXX, Bloomberg, etc. The international index provider MSCI includes MOEX’s shares in the MSCI Russia Index and the MSCI Emerging Markets Index.

Shareholder | 31 December 2020 | 31 December 2021 | ||

|---|---|---|---|---|

Voting power (units) | Voting power (%) | Voting power (units) | Voting power (%) | |

Central Bank of the Russian Federation | 268,151,437 | 11.780 | 268,151,437 | 11.780 |

Sberbank of Russia | 227,682,160 | 10.002 | 227,682,160 | 10.002 |

VEB.RF | 191,299,389 | 8.404 | 191,299,389 | 8.404 |

EBRD | 138,172,902 | 6.070 | 120,472,902 | 5.292 |

Capital Research and Management Company | 130,253,299 | 5.722 | 14,398,523 | 0.633 |

MICEX-Finance | 18,551,238 | 0.815 | 18,922,617 | 0.831 |

Free float (excl. MICEX-Finance; incl. Capital Research and Management Company) | 1,432,544,332 | 62.930 | 1,449,872,953 | 63.691 |

The Exchange has no shareholders possessing any degree of control over the company disproportionate to their holding of the Exchange’s share capital, as per a shareholder agreement or other agreement. The Exchange has not issued preferred shares, such as those with a different nominal value. The share capital structure does not include any instrument that would provide the holder control over the company disproportionate to its stake in the company.

As of 31 December 2021, the total number of MOEX shareholders was 379,018, including 377,912 individual shareholders. MICEX-Finance, a controlled entity of the Exchange, held 18,922,617 shares (0.831% of the share capital).

In 2021, the Exchange executed no special-purpose related-party transactions with its shareholders. All transactions were of market nature and were executed on terms and conditions similar to those applied in transactions with other counterparties of the Exchange.

REGISTRAR

Full company name | Joint-Stock Company “Registry company STATUS” |

|---|---|

Place of business: | 23/1 Novokhokhlovskaya St., Office 1, 109052, Moscow Russian Federation |

Registration details | State registration certificate No. 066.193 from 20 June 1997, certificate to confirm the legal entity from 4 July 2002 |

Primary State Registration Number (OGRN) | 1027700003924 |

Licence | Registrar License No. 10-000-1-00304 from 12 March 2004 (without limitation of the period of validity) issued by the Federal Financial Market Service |

Contact details | General enquiries: +7 (495) 974-83-50 Shareholders service enquiries: +7 (495) 974-83-47 Fax: +7 (495) 678-71-10 E-mail: office@rostatus.ru |

For more details, please visit the company’s website: www.rostatus.ru.

MOEX SHARE PERFORMANCE

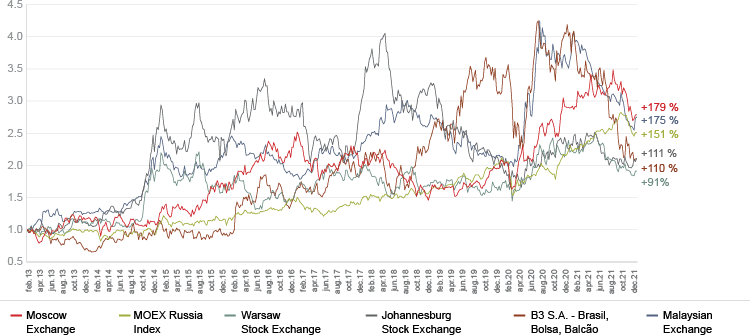

As of the end of 2021, Moscow Exchange’s market capitalization was RUB 348,8 bn (versus RUB 362.5 as at the end of 2020). Since MOEX’s IPO in 2013, the share price has increased by 179% excluding dividend payments.

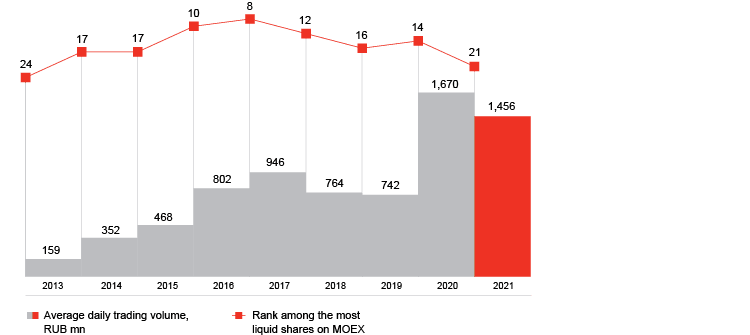

In 2021, the average daily trading volume (ADTV) of the company’s shares was more than RUB 1 billion for the second consecutive year.

* All quotes are in RUB.

** Versus ordinary and preferred shared admitted to trading on MOEX’s Equity Market, by trading volume in the main trading mode.

DIVIDENDS

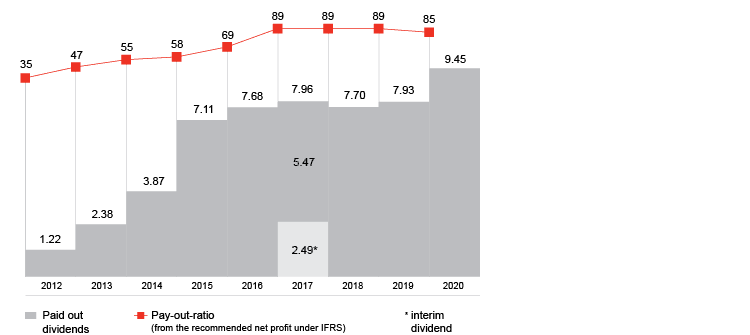

For 2020, Moscow Exchange’s Annual General Meeting of Shareholders (AGM) resolved to distribute dividends in the amount of RUB 9.45 per share. In total, RUB 21.5 bn was allocated for the payment of dividends, equivalent to 85% of the 2020 IFRS consolidated net income of the Exchange. The Exchange’s Dividend Policy, which was approved by the MOEX Supervisory Board in October 2019, requires that dividends equal at least 60% of IFRS consolidated net income. The target level of the profit allocated for dividend payment is determined as the free cash flow to equity (FCFE).

Dividend payment year | Dividend period | Announcement date, shareholders meeting minutes No. | Total pre-tax amount of dividends declared and paid (RUB) | Dividend record date |

|---|---|---|---|---|

2013 | for 2012 | 25 May 2013, Minutes of AGM No. 49 | 2,901,756,800 | 20 May 2013 |

2014 | for 2013 | 26 June 2014, Minutes of AGM No. 52 | 5,423,154,900 | 11 July 2014 |

2015 | for 2014 | 28 April 2015, Minutes of AGM No. 53 | 8,818,323,227.91 | 12 May 2015 |

2016 | for 2015 | 29 April 2016, Minutes of AGM No. 54 | 16,201,105,465.23 | 16 May 2016 |

2017 | for 2016 | 28 April 2017, Minutes of AGM No. 56 | 17,482,763,197.44 | 16 May 2017 |

2017 | for H1 2017 | 14 September 2017, Minutes of AGM No. 57 | 5,668,239,600 | 29 September 2017 |

2018 | for 2017 | 26 April 2018, Minutes of AGM No. 58 | 12,451,915,975.26 | 15 May 2018 |

2019 | for 2018 | 25 April 2019, Minutes of AGM No. 59 | 17,528,291,226.60 | 14 May 2019 |

2020 | for 2019 | 28 April 2020, Minutes of AGM No. 61 | 18,051,863,561.94 | 15 May 2020 |

2021 | for 2020 | 28 April 2021, Minutes of AGM No. 62 | 21,511,993,778.10 | 14 May 2021 |

In accordance with the Federal Law on Joint Stock Companies, the deadline for payment of dividends to a nominee registered in the shareholder register should not exceed 10 business days, and to other persons registered in the shareholder register - 25 business days from the dividend record date.

INVESTOR RELATIONS

Moscow Exchange engages with existing and prospective investors to provide them with an overview of the activities of the company and raise awareness of MOEX’s business with the aim of continually diversifying the shareholder base. Investor relations activities are scheduled in such a manner that any investor has the opportunity to interact with and ask questions of MOEX management at least once a year and receive all the information s/he needs in a timely manner in order to make reasonable investment decisions. It is one of Moscow Exchange’s priorities to adhere to the highest standards of information disclosure given its roles as both a public company and operator of Russia’s core financial markets infrastructure.

Amid the pandemic, communication with shareholders and investors went to an online - format. In 2021 Moscow Exchange’s management held 241 meetings (also online) with institutional investors and analysts and took part in 15 international conferences for investors. It held online roadshows in cooperation with global brokers. It held online roadshows in cooperation with global brokers.

Years | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|

Number of meetings with investors | 180 | 236 | 270 | 349 | 355 | 326 | 318 | 261 | 241 |

In total, in 2021, Moscow Exchange’s management contacted 121 institutional investors who, according to Nasdaq IR Insight, at the end of 2021 owned 44% of the company’s free float (as compared to 38% in 2020). 27% business contacts were investors from North America, 26% from the UK, 17% from continental Europe, 10% from Russia, 10% from Africa, 8% from Asia and 2% from other regions.

Region | 2020 | 2021 |

|---|---|---|

North America | 31 | 27 |

United Kingdom | 22 | 26 |

Continental Europe | 24 | 17 |

Russia | 12 | 10 |

Asia | 3 | 8 |

Others | 7 | 2 |

MOEX also places strong emphasis on engaging with retail investors. The number of retail shareholders exceeded 377,000 as of the end of 2021. Against the backdrop of the growing activity of individuals on the stock market, Moscow Exchange is implementing a number of initiatives aimed at improving the financial literacy of individual investors (see the “Exchange and the Community” chapter). Moscow Exchange management participates in a wide range of public events and webinars organised by Moscow Exchange and external partners. Since 2014, MOEX has run an annual Shareholder Day for retail investors, an event in the form of a conference call with representatives of senior management. At another such event on 14 April 2021, the management of the Exchange spoke about new projects and the company’s development prospects, as well as answered questions about corporate governance and initiatives to attract private investors to the Russian financial market.

INVESTORS’ OPINION ON INVESTOR RELATIONS AT MOSCOW EXCHANGE

Since 2014, Moscow Exchange has annually commissioned a perception study to learn more about how MOEX is viewed by investors and analysts.

No response | Good | Very good | Excellent | |

|---|---|---|---|---|

Knowledge of the business | 4 | 0 | 24 | 72 |

Quality of IR materials | 4 | 0 | 16 | 80 |

Quality of conference calls and webcasts | 8 | 0 | 20 | 72 |

Confidence and transparency | 4 | 0 | 32 | 64 |

Responsiveness | 4 | 0 | 20 | 76 |

Friendliness/helpfulness | 4 | 0 | 12 | 84 |

Access to the management | 12 | 4 | 28 | 56 |

ANALYSTS

MOEX’s performance is closely monitored by leading Russian and international banks.

They publish regular reports on MOEX’s shares as well as provide stock recommendations and financial forecasts.

Company | Analyst | Telephone number | Tel. |

|---|---|---|---|

Bank of America | Olga Veselova | +7 (495) 662 6080 | |

Citigroup | Samarth Agrawal | +44 (20) 7986 4225 | |

Goldman Sachs | Makhail Butkov | +7 (495) 645 4073 | |

HSBC Bank plc | Andrzej Nowaczek | +44 (20) 7991 6709 | |

Raiffeisen Centrobank | Sergey Garamita | +7 (495) 721 9900 | |

Sberbank CIB | Andrew Keeley | +44 (20) 7936 0439 | |

Kirill Rogachev | +7 (495) 933 9817 | ||

Sinara FC | Olga Naidyonova | +7 (495) 771 7095 | |

SOVA Capital | Andrey Mikhailov | +7 (495) 213 1829 | |

Wood & Company | Paweł Wieprzowski | +48,222,221,549 | |

Alfa Bank | Eugene Kipnis | +7 (495) 795 3713 | |

Aton | Mikhail Ganelin | +7 (495) 213 0338 | |

BCS | Elena Tsareva | +7 (495) 213 1537 | |

VTB Capital | Svetlana Aslanova | +7 (495) 663 4788 | |

Mikhail Shlemov | +7 (495) 663 4701 |

As of 31 December 2021, the market consensus forecast for MOEX shares based on forecasts of thirteen analysts was RUB 191.08 per share.